Our Investment Philosophy

Attivo Investments was created to manage your money in a way that fits your life and goals. We partner with SEI, a trusted global leader in investments, to bring you expert solutions that work seamlessly with the plans you’ve made alongside your Financial Planner.

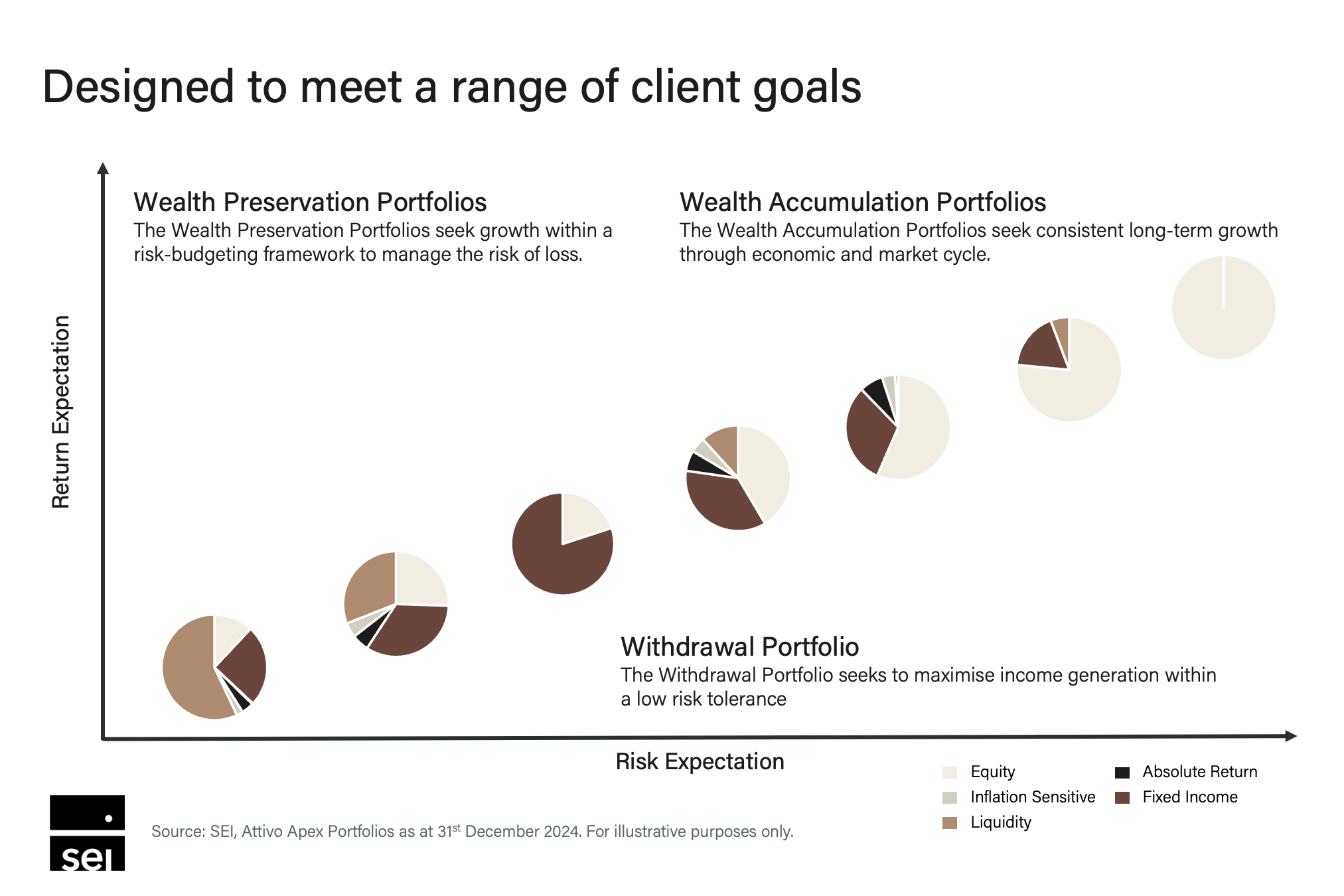

Goal Based Investing

We believe investments should focus on helping you achieve your financial goals, not just chasing returns. Whether you’re growing your savings, protecting your wealth, or creating an income, our strategies are designed to keep you on track throughout the market cycles you are invested in.

Global Expertise

By partnering with SEI, designing and building the models together, we give you access to a team of global experts managing over $400 billion. This allows us to offer high-quality investment strategies at competitive costs, ensuring your money is managed efficiently and with innovation.

Goal based Investing is for Today’s Challenges

The world is constantly changing, with challenges like inflation, rising interest rates, and global shifts. Our approach adapts to these changes, ensuring your investments remain resilient and focused on what matters most: your financial goals.

A Smarter Way to Manage Money

Traditional investing often focuses on maximising returns without considering personal goals. Our goal-based approach tailors your investments to meet your specific needs, like saving for retirement, preserving your wealth, or generating income. This personalised approach helps you feel confident and supported every step of the way.

Why Attivo Investments Stands Out

We offer a modern way to invest, giving you access to strategies usually reserved for large institutions. Our model portfolios are designed to help protect your money during market dips while offering opportunities for growth. This ensures your investments align with your goals and adapt as your life changes.

How We Build Your Portfolio

We carefully select top investment managers who have a proven track record of success. Our team continuously monitors the model portfolio to ensure it stays aligned with the goals it was designed for and performs as expected.

Preservation

If your goal is to protect the wealth you’ve built, our preservation models focus on steady, secure growth. These are ideal for goals like retirement income, leaving an inheritance, or maintaining your financial stability during uncertain markets.

Accumulation

If you’re focused on growing your wealth over time, our accumulation models are built for long-term planning. Whether you’re saving for retirement, a big life milestone, or future security, these portfolios are designed to grow your investments steadily and confidently.

Withdrawal

For those needing regular income, our withdrawal models are designed to provide a reliable quarterly payment. This ensures you can access your money when you need it, without taking unnecessary risks.

Investment Strategies

This approach is designed to keep fees low while focusing on long-term growth. These portfolios use simple, cost-effective investment options to match market performance and help you achieve your goals.

The models

Low-Cost Models with a Preservation Goal

Low-Cost Preservation Cautious

Low-Cost Preservation Moderate

Low-Cost Models with an Accumulation Goal

Low-Cost Accumulation Progressive

Low-Cost Accumulation Growth

Our core range balances cost and performance, using a mix of proven investment strategies to deliver better results over time. These portfolios are actively managed to protect your money during market downturns and offer growth when conditions improve.

The models

Core Models with a Preservation Goal

Core Preservation Conservative

Core Preservation Cautious

Core Preservation Moderate

Core Models with an Accumulation Goal

Core Accumulation Balanced

Core Accumulation Progressive

Core Accumulation Growth

Core Model with a Withdrawal Goal

IT Core Withdrawal Moderate

For experienced or high-net-worth investors, our Apex range includes advanced investment options like hedge funds and private equity. These portfolios aim for higher returns with strategies tailored to maximise opportunities while managing risk.

The models

Apex Models with a Preservation Goal

Apex Preservation Conservative

Apex Preservation Cautious

Apex Preservation Moderate

Apex Models with an Accumulation Goal

Apex Accumulation Balanced

Apex Accumulation Progressive

Apex Accumulation Growth

This approach is designed to keep fees low while focusing on long-term growth. These portfolios use simple, cost-effective investment options to match market performance and help you achieve your goals.

Our core range balances cost and performance, using a mix of proven investment strategies to deliver better results over time. These portfolios are actively managed to protect your money during market downturns and offer growth when conditions improve.

For experienced or high-net-worth investors, our Apex range includes advanced investment options like hedge funds and private equity. These portfolios aim for higher returns with strategies tailored to maximise opportunities while managing risk.

The models

Low-Cost Models with a Preservation Goal

Low-Cost Preservation Cautious

Low-Cost Preservation Moderate

Low-Cost Models with an Accumulation Goal

Low-Cost Accumulation Progressive

Low-Cost Accumulation Growth

The models

Core Models with a Preservation Goal

Core Preservation Conservative

Core Preservation Cautious

Core Preservation Moderate

Core Models with an Accumulation Goal

Core Accumulation Balanced

Core Accumulation Progressive

Core Accumulation Growth

Core Model with a Withdrawal Goal

IT Core Withdrawal Moderate

The models

Apex Models with a Preservation Goal

Apex Preservation Conservative

Apex Preservation Cautious

Apex Preservation Moderate

Apex Models with an Accumulation Goal

Apex Accumulation Balanced

Apex Accumulation Progressive

Apex Accumulation Growth

Your Financial Planner will work with you

Your Financial Planner will work with you to select the most suitable model portfolio for your needs and comfort with risk. This will fit into one of the three model portfolio ranges we offer. These options ensure your investments match your risk comfort level and life stage, whether your goal is saving, growing, or withdrawing your money.

Low-Cost Light Goal Based

Passive Funds of Funds Structure

Characteristics of the Core MPS Range

Our Core portfolios are designed for investors who are looking to strike a balance between controlling cost and generating above-average returns via active management. Our Core portfolios have an enhanced investment strategy relative to the Low-Cost portfolios which we feel can add more value over time.

Optimal Goal Based enhancing downside protection

Active Building Blocks

Additional Return Sources

Manager of Manager

Benefits of the APEX MPS Range

Our Apex portfolios are designed for investors who are looking to maximise the potential for excess returns via active management, with a dynamic overlay. These portfolios are for sophisticated investors and will include a higher amount of alternative assets such as hedge funds.

Optimal Goal Based Enhanced downside protection

Active Building Blocks With Dynamic Overlay

Additional return alongside Dynamic Asset Allocation and hedge fund Exposure

Manager of Manager

Goal based investing aligned to your financial planning conversations